At The Family Bbq, My Brother’s Son Said, ‘charity Cases Eat Last,’ And They All Giggled…

The Barbecue and the Breaking Point

At the family barbecue, my brother’s son said, “Charity cases eat last.” And they all giggled.

I put my plate down and walked out. That night, Dad texted, “The business needs your investment.” I replied, “Never again.”

The next morning, one notice went out and their laughter turned to tears. Drop a comment and let me know where you’re listening from and what time it is for you right now.

Since we are stepping into 2026, I want to wish everyone a year of strength and clarity. I really hope you continue to support this channel as we share these stories.

The humidity at the lakehouse wasn’t just weather; it was an atmosphere. It pressed down on the Vanguard Logistics 40th anniversary garden party like a wet wool blanket, trapping the smell of expensive cologne and the clinking of crystal glasses in the heavy air.

My parents, Joseph and Susan, had spent $50,000 to turn the lawn into a showroom of their success. There were white tents, a string quartet sweating in their tuxedos, and enough seafood to feed a small navy.

It was performative wealth at its finest, a stage designed to convince the investors that the company was thriving, even though I knew the balance sheet said otherwise. I stood on the periphery holding a glass of lukewarm water.

That was my place in the family geometry—always on the edge. I was essential for the headcount but irrelevant to the conversation.

My brother Christopher, the chief operating officer, was holding court near the open bar. He was wearing a suit that cost more than my first car, laughing too loudly at a joke made by a potential client.

His wife Morgan stood beside him, her smile fixed and bright, scanning the crowd for anyone more important to talk to. I was hungry.

I hadn’t eaten since breakfast because I’d spent the morning reviewing the portfolio adjustments for my actual clients. They were the ones who knew I managed $200 million in assets, not the family who thought I was a back-office paper pusher.

I walked toward the buffet tables. The spread was impressive with lobster tails, oysters on the half shell, and towers of shrimp.

I reached for a plate. That was when Mason, Christopher’s 12-year-old son, stepped in front of me.

He didn’t bump into me; he blocked me. He stood guard over the chilled prawns with a smirk that was a carbon copy of his father’s.

He looked me up and down, his eyes bright with the permission to be cruel that he’d absorbed from the adults around him. “Dad says charity cases eat last,” he announced.

His voice wasn’t a whisper; it carried over the low hum of the string quartet. A few guests nearby turned their heads.

I looked past Mason to Christopher. My brother had heard it.

He looked right at me, took a sip of his scotch, and smirked. He didn’t correct his son, he didn’t apologize, and he validated it with his silence.

My parents, standing 10 feet away, suddenly found the floral arrangements fascinating. In that moment, time didn’t stop, but my perspective shifted.

I didn’t feel the sting of tears or the flush of embarrassment I usually felt. Instead, I felt a cold, terrifying clarity.

People think family trauma is a sudden break, a single event that shatters everything. It isn’t.

The Bank of Tolerance Is Closed

It is a bank account. For 31 years, I had been making deposits into a bank of tolerance.

I deposited my silence when they forgot my graduation. I deposited my dignity when they mocked my boring job.

I deposited my pride every time they treated me like an obligation they couldn’t quite shake off. I had been paying compound interest on their disrespect, assuming that someday, if I paid enough, I would buy their love.

But looking at a child sneering at me with my brother’s face, I realized the ledger was full. The account was overdrawn, and there was no more credit to extend.

I wasn’t sad; I was simply done doing business with them. “Understood,” I said softly.

I set the empty plate back on the stack with a deliberate click. I didn’t look at Christopher, and I didn’t look at my parents.

I turned and walked toward the side gate. “Alyssa, don’t be dramatic,” Morgan called out, her voice shrill.

“He’s just a kid.” She added.

I didn’t answer; I kept walking. The gravel crunched under my heels, a satisfying final sound.

I walked past the valet stand, past the rows of luxury cars, and got into my modest sedan. I sat there for a moment in the silence, the air conditioning blasting against the sweat on my neck.

I checked my phone. There were no missed calls and no texts asking if I was okay, just the silence I had always known.

I put the car in gear and drove away. I wasn’t just leaving a party; I was driving toward the biggest transaction of my life.

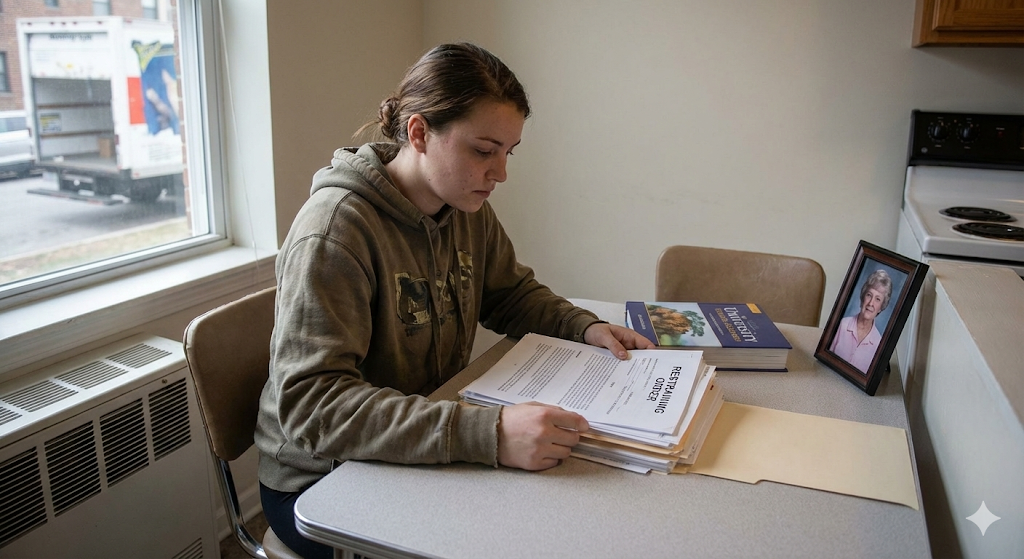

The bank of trauma was closed, and tomorrow I was calling in the debt. My apartment was 40 minutes away from the lakehouse, but it might as well have been on a different planet.

It was a penthouse in the financial district, bought with cash three years ago. The air was cool and filtered, smelling of lemon verbena and silence.

There were no family photos on the walls, just modern art and the city skyline glowing through floor-to-ceiling windows. This was the sanctuary I had built with the money they thought I didn’t have, doing the job they thought I couldn’t do.

I kicked off my heels and poured a glass of water, my hand perfectly steady. Sociologists have a term for siblings like me; they call us glass children.

We are the ones born healthy in families consumed by a sick child, or in my case, the ones born competent in a family consumed by a golden child. We aren’t broken, so we aren’t fixed.

We aren’t shiny, so we aren’t displayed. We are just glass—transparent, functional, and looked through to see the things that actually matter.

For 31 years, my parents had looked right through me to admire Christopher. Christopher, who had failed the bar exam twice and who needed a chief operating officer title to feel important.

They polished him until he gleamed, never noticing that I was the structural integrity holding up the display case. They thought I was a portfolio assistant or a clerk, a boring paper pusher who balanced checkbooks.

The truth was, I was a senior portfolio manager for a private wealth firm. I didn’t balance checkbooks; I restructured estates.

I didn’t manage thousands; I managed hundreds of millions. My personal net worth was north of $20 million, accumulated through aggressive, high-risk trading in my 20s.