My Family Treated Me Like A Servant While Selling Our $340m Company. They Had No Idea I Secretly Own 82% Of The Shares. Should I Fire Them All On The Spot?

“Second, Vanessa, the marketing budget is being cut by 40%. You’ve been spending $200,000 per quarter on brand awareness campaigns that generate zero measurable return. We’re refocusing on digital strategies with actual ROI metrics.”

Vanessa’s face had gone crimson. “Those campaigns are industry standard!”

“They’re industry waste,” I corrected.

“Third, Patricia, your consulting fee of $15,000 per month is terminated immediately. You’ve attended four meetings in two years and contributed nothing beyond champagne preferences.”

Patricia looked like she might faint. I turned to Dad.

“Richard Jensen, you’ll remain as CEO, but with revised compensation tied to company performance rather than personal draws. Your salary is being restructured to match industry standards for a company of this size: $280,000 base, with performance bonuses replacing the $650,000 you’ve been taking annually.”

“Emily…” Dad’s voice was barely above a whisper. “This is still my company. I built this.”

“Grandpa Jack built this,” I said firmly. “You managed it. There’s a difference. He started with a garage and a dream. You inherited a successful operation and maintained it competently, I’ll grant you. But you were always planning your exit strategy. He loved the work; you loved the paycheck.”

Uncle Tom cleared his throat. “And Linda and I?”

“Your shares remain unchanged,” I said. “You’re minority investors who’ve never taken more than the dividends you’re entitled to. You’re welcome to stay involved or step back—your choice. But the days of treating Jensen Technologies as a family piggy bank are over.”

I disconnected my phone from the display and gathered my notes. “I’ll be in Grandpa Jack’s old office starting Monday,” I said. “I’m moving into the operational management role as Executive Chairperson. Dad will schedule a meeting to discuss the transition plan.”

“Derek, Vanessa, HR will be in touch about your new roles.”

“New roles?” Derek sputtered. “You’re demoting us?”

“I’m right-sizing you,” I said. “You can stay with the company in positions that match your actual contributions, or you can leave. Your choice.”

“This is insane!” Patricia said, her voice shaking. “Richard, are you going to let her do this?”

Dad was staring at the valuation report still displayed on the wall. “$120 million below market value,” He said quietly. “I almost sold for $120 million less than it’s worth.”

“You were selling your inheritance,” I said softly. “Grandpa Jack knew you would. That’s why he made sure I could stop you.”

Vanessa found her voice, though it cracked. “So what? You’re just going to run everything now? You, who knows nothing about…”

“I know the company did $89 million in revenue last year with a 23% profit margin,” I interrupted. “I know our strongest market is commercial electronics distribution in the Pacific Northwest, with emerging strength in medical device supply chains.”

“I know our biggest operational inefficiency is the fulfillment center in Portland, which runs at 68% capacity because Derek negotiated a lease three times larger than we needed.”

Derek had no response.

“I know our three most valuable employees are Sarah Chin in logistics, Marcus Thomas in operations, and Jennifer Wu in product development—none of whom have received raises in 18 months despite being head-hunted regularly by competitors. That changes Monday.”

I turned to leave, then paused at the door. “One more thing,” I said. “The penthouse in Manhattan, Patricia; the yacht, Derek; the Aspen property, Vanessa—consider those dreams postponed. But if you work with me instead of against me, if you actually contribute to building this company instead of harvesting it, maybe we’ll all do well enough that you can afford those things eventually.”

“And if we refuse?” Vanessa challenged.

“Then you can exercise your right as minority shareholders to sell your shares,” I said. “I’m sure you can find a buyer, though I should mention that as controlling shareholder, I have right of first refusal. And I’ll be valuing those shares based on the same careful analysis Grandpa Jack taught me.”

I left them sitting in stunned silence and walked down the hall to Grandpa Jack’s office—my office now. The door had been locked since his death, preserved like a museum. I had the key. I’d always had the key.

Inside, everything was exactly as he’d left it: the worn leather chair, the wall of books about manufacturing, distribution, and business ethics. I saw the photo of us together at my college graduation, from the business program I’d completed online while caring for him—the graduation my family hadn’t attended because it wasn’t Stanford.

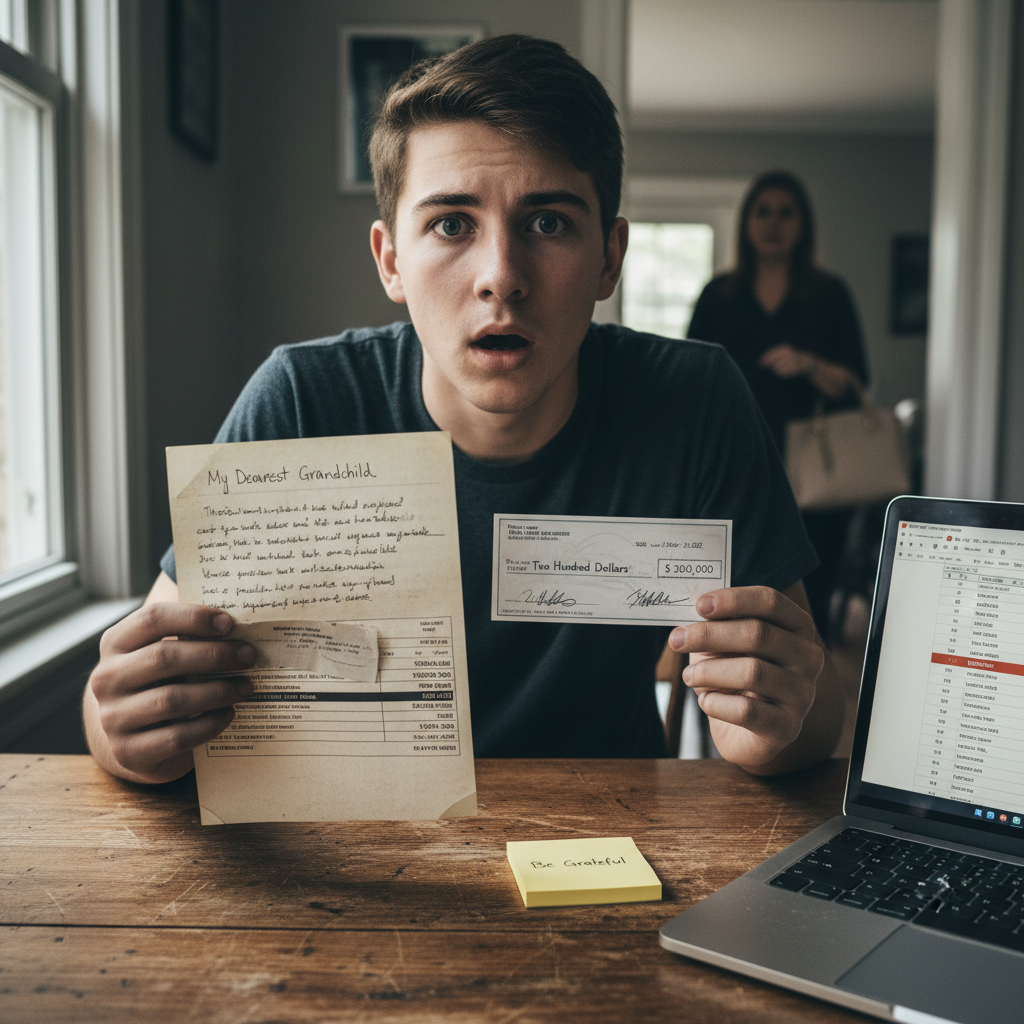

On the desk, in a sealed envelope with my name on it, was a letter. I’d known it was here—Margaret had told me about it—but I’d waited until today to read it.

“Emily, if you’re reading this, you’ve reached 28 and claimed your inheritance. I hope I taught you enough. I hope you’re ready.”

“Your father is a good man, but he mistakes money for success and status for achievement. Your stepmother and step-siblings see the company as a resource to extract rather than a legacy to build. I don’t blame them; our culture teaches that exit strategies are smart and cashing out is winning.”

“But you understood, even as a child, that building something matters more than selling it. You asked better questions. You cared about the employees, not just the earnings reports. You saw the company as a living thing that needed tending, not a commodity to trade.”

“The shares are yours, not because you’re my blood—though you are and I love you—but because you’ll protect what I built better than anyone else. You’ll face resistance. Your family will call you naive, accuse you of sentiment over sense, and question your every decision. Stand firm. Trust your preparation.”

“Remember that real leadership isn’t about making everyone happy; it’s about making the right choices even when they’re hard. Build something that matters, Emily. Make me proud. Love always, Grandpa.”

I folded the letter carefully and placed it in my desk drawer. Through the office window, I could see the manufacturing floor where 347 employees worked. They were people with families, mortgages, and dreams—people who’d been hours away from having their livelihoods sold to a corporate acquirer that would have eliminated 40% of positions within a year.

My phone buzzed. A text from Margaret Chin: “The documentation is filed. You’re officially on record as controlling shareholder and executive chairperson. How does it feel?”

I looked around the office, felt the weight of responsibility settling onto my shoulders like a familiar coat. “Feels like coming home,” I typed back.

Another text came from an unknown number: “This is Sarah Chin from logistics. Marcus told me what happened in the board meeting. Thank you. Some of us have been hoping someone would stand up to them for years.”

Then another: “Jennifer Wu here. Heard you’re taking over. Does this mean the innovation lab project might actually get funded?”

And another: “Tom Jensen. Your grandfather would be proud. I’m sorry I didn’t see what he saw sooner. If you need an ally on the board, you have one.”

I spent the rest of the afternoon in that office reviewing 12 years of financial reports, operational data, and employee files. By the time the sun set, I had a clear picture of everything that needed to change.

At 7 p.m., Dad knocked on my door. He looked older than he had that morning, the confidence stripped away to reveal something more uncertain.

“Can I come in?” I nodded, gesturing to the chair across from my desk.

He sat slowly, looking around the office. “I haven’t been in here since he died. I couldn’t face it.”

“I know,” I said.